TLDR

- Stablecoins have not solved the perennial issue of being stable yet maintaining decentralization and capital efficiency

- Thala Labs aims to solve the trilemma by creating a censorship-resistant stablecoin without compromising capital efficiency

- The team is building a DeFi stack which primarily revolve around three key components: a stablecoin, automated market maker (AMM) and a launchpad

- Signum Capital believes that Thala Labs will lay the bedrock for the Aptos DeFi Ecosystem

Introduction

Stablecoins have been integral to the DeFi ecosystem due to the need for liquidity across various blockchains while serving important financial services such as facilitating cross-border exchanges and being a store of value.

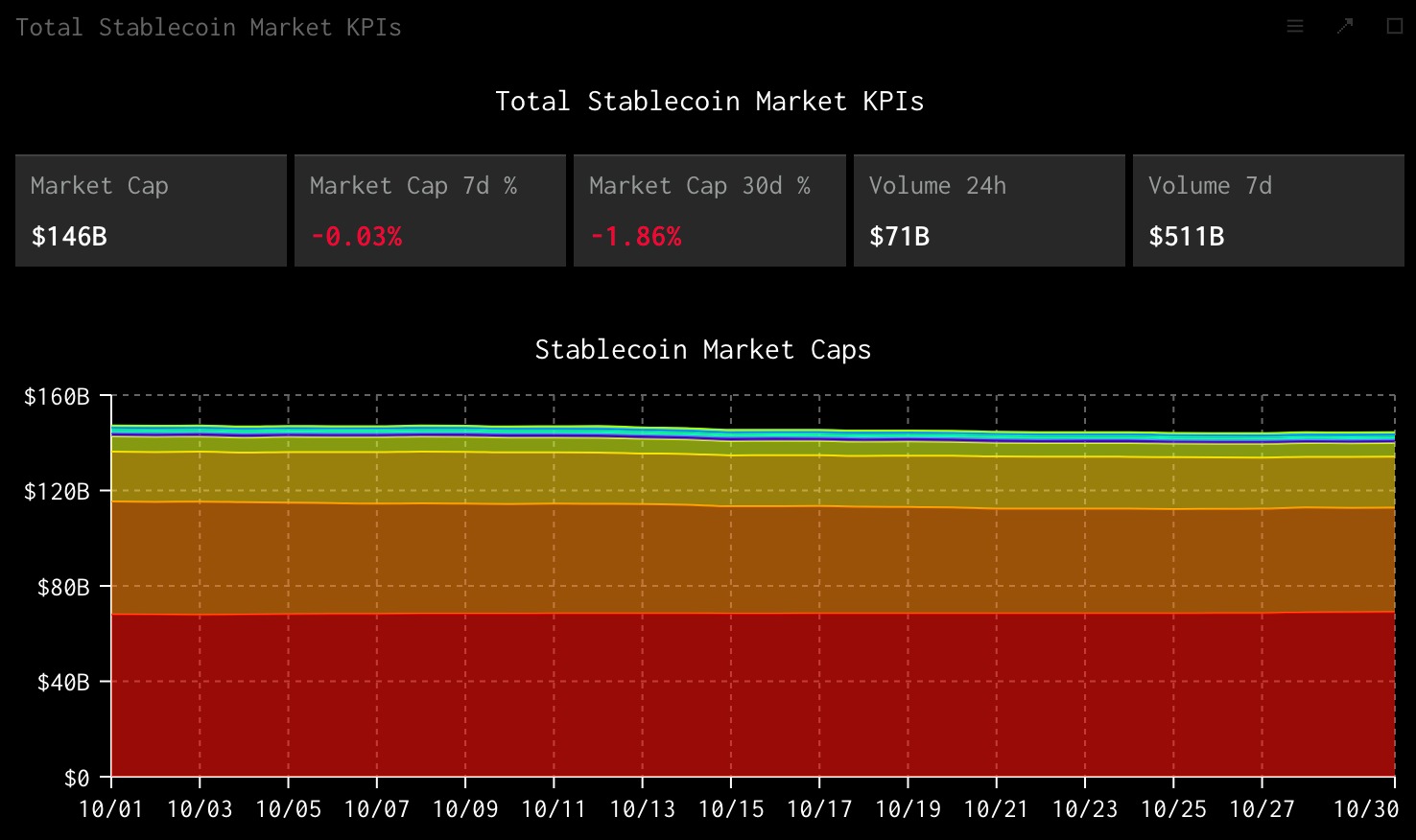

According to data published by stablecoins.wtf, the stablecoin market cap is at roughly $150bn with USDT having the lion’s share at $69bn. The exponential growth of DeFi over the past 3 years has led to a surge in demand for cryptocurrencies that guarantee price stability.

Different type of stablecoins have emerged in recent years with various stability mechanisms and tradeoffs:

- Fiat backed stablecoins such as USDT, USDC and BUSD: backed with actual Fiat currency (USD) which is the most stable type of stablecoin but is relatively centralised and lacks transparency on the issuer’s accounts.

- Crypto backed stablecoins such as DAI and FRAX: these are backed by other on-chain tokens such as ETH. To account for the inherent volatility of this type of stablecoin, an over-collateralized model is usually deployed (which is usually capital inefficient).

- Algorithmic stablecoins such as UST: employ algorithms to balance the supply and demand and the value of the stablecoin is controlled by a second token. The crash of UST earlier this year highlighted the significant risk with this type of model as it ultimately relies on the value/ strength of the second token.

Thala’s attempt at developing its own stablecoin falls into the 2nd type where it uses a basket of digital assets to back the stablecoin.

Innovation at Thala Labs

Thala Labs is developing three products that will be native to the Aptos blockchain: a stablecoin (Move Dollar), ThalAMM and a launchpad.

A. Move Dollar Stablecoin

Move Dollar (MOD) is an over-collateralized, yield-bearing stablecoin backed by a basket of on-chain assets. This includes liquid staking derivatives, liquidity pool (LP) tokens, deposit receipt tokens and more.

MOD is designed so that it will consistently trade at the $1 peg:

- Overcollateralization: users can only mint (”borrow”) an amount less than the value of the collateral, such that the value of collateral in the system always exceeds the value of stablecoin in circulation.

- Users with open positions will be given an option to redeem MOD for $1 (minus redemption fee) worth of collateral, such that the effective price floor is $1.

- A liquidation process will occur when the collateralization of a user’s vault falls under what is deemed safe for the backing of MOD.

Thala aims to tackle the issues surrounding decentralization, peg security and capital efficiency in a variety of methods:

- Decentralization: MOD is primarily collaterized by decentralized and yield bearing assets, whereby the protocol parameters will ensure that the existing backing remains largely decentralized, therefore avoiding the vulnerabilities of centralized protocols.

- Peg Security: MOD allows for direct redemptions, dynamic interest rates to control supply by expansion and contraction, and stability pools to hedge against the risks of liquidation in order to maintain a robust peg and a resilient ecosystem.

- Capital efficiency: Thala Labs turns idle, yield-bearing collateral into productive assets, which generates yield flows back to holders of MODs. Thala Labs also has plans to onboard real world assets (RWAs), which is aligned with unlocking more capital efficiency in the long run.

B. ThalAMM

Thala Lab’s rebalancer AMM allows for the creation of autonomous index funds, multi-asset pools, stable pools, among others. As a vertical integration of MOD, the platform will prioritize the stablecoin as the base asset, enabling deep liquidity and additional utility.

C. Launchpad

Built on top of ThalAMM, Thala’s launchpad enables permissionless distribution of tokens for other Aptos native projects via a liquidity bootstrapping pool (LBP) mechanism. This service allows projects to fairly distribute their tokens to various market participants.

THL Governance Token

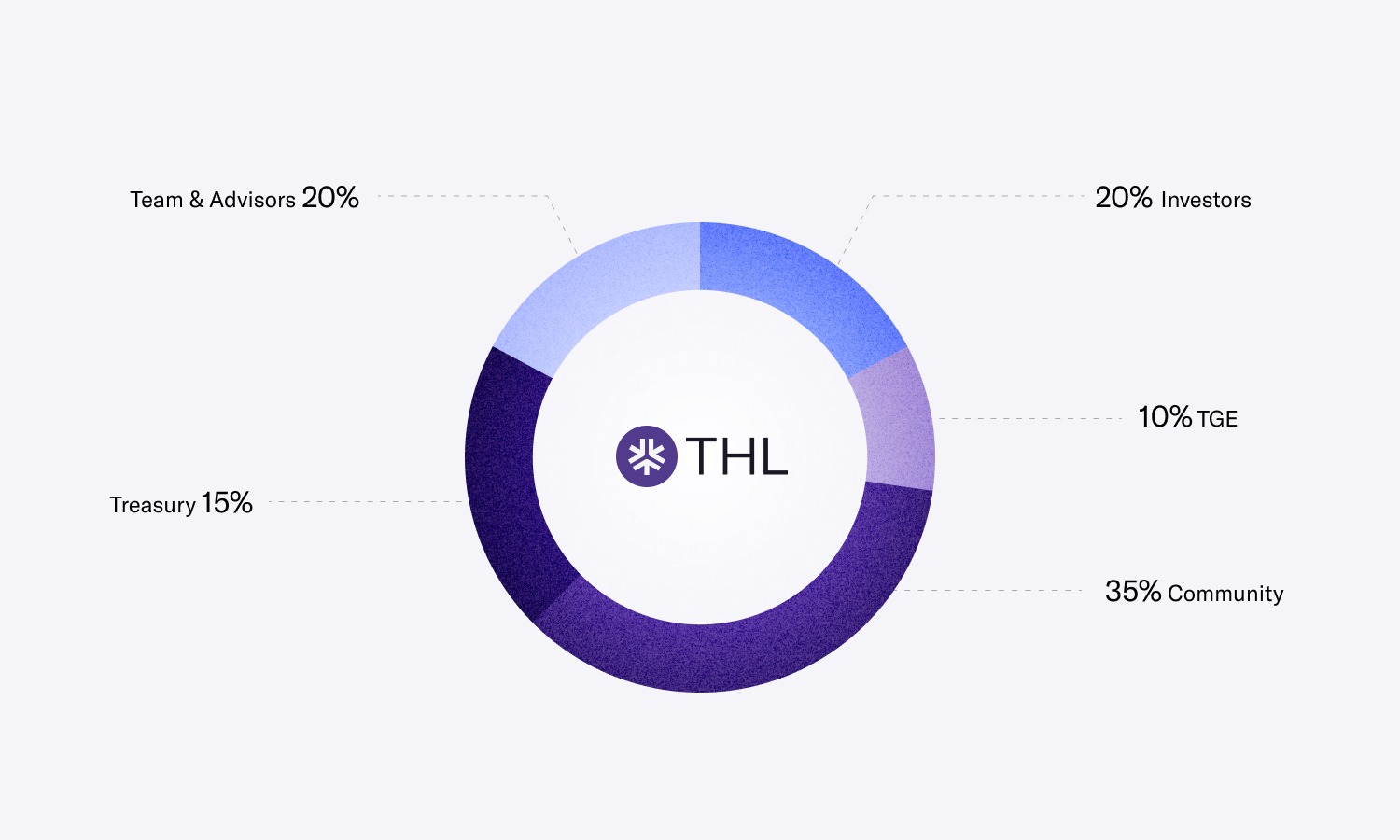

The total supply of the THL token will be 100,000,000 tokens. This will be split between the team, investors, treasury and the public as can be seen below:

Apart from governance utility, holders of the THL token will be able to stake their tokens to earn fees generated by the protocol which includes:

Apart from governance utility, holders of the THL token will be able to stake their tokens to earn fees generated by the protocol which includes:

- Strategies on yield-bearing collateral deposits

- Interest rates accrued from open vaults (CDPs)

- Minting fees on certain collateral types

- Fees accrued from launchpad and rebalancer AMM

Our Thoughts

After several conversations, we were impressed with the team’s knowledge of the stablecoin ecosystem and their vision for the future of their project. As part of our due diligence into the team, we found that they have a core set of seasoned developers that hail from reputable companies such as Google, Dapper Labs, ParaFi Capital, BitGo and Terraform Labs.

Apart from the team, Thala Labs has several qualities that attracted us to their project:

- Good business model that has found success on other blockchains

- THL token has a clear utility and value accrual

- Ability to enable deep liquidity across the whole Aptos ecosystem

Backers

Thala Labs closed a $6m round in October 2022 which was co-led by industry behemoths such as ParaFi Capital, Shima Capital and Whitestar Capital. Alongside our participation, other backers include UOB Ventures, Beco Capital, LedgerPrime, Qredo, Kenetic Capital, Big Brain Holdings, Builder Capital, Serafund, Saison Capital, Infinity Ventures Crypto and other strategic angels.

Advisors of the protocol include Nick Chong (ex investor at ParaFi Capital), Sally Wang (ex VP at Sino Global Capital) and DCF God (popular crypto anon and angel investor).

Thala Labs will be using the funds to expedite hiring of key personnel as well as complete more audits of its protocol. As of date, there are 13 members on the team including the founders and they have already completed a formal audit with Zellic, a prominent smart contract audit firm in the Aptos ecosystem.

Closing statements

We are very proud to back Thala Labs in their efforts to establish itself as one of the linchpins of the Aptos ecosystem by building a comprehensive DeFi stack. Through our expertise and market intelligence, the team at Signum Capital will support Thala Labs to the best of our abilities and we are extremely excited for the future trajectory of the team.

Related links

Thala docs: https://thala-labs.gitbook.io/thala-docs/

Website: https://www.thala.fi/

Twitter: https://twitter.com/ThalaLabs