Trends and Developments of the Crypto Venture Capital Industry

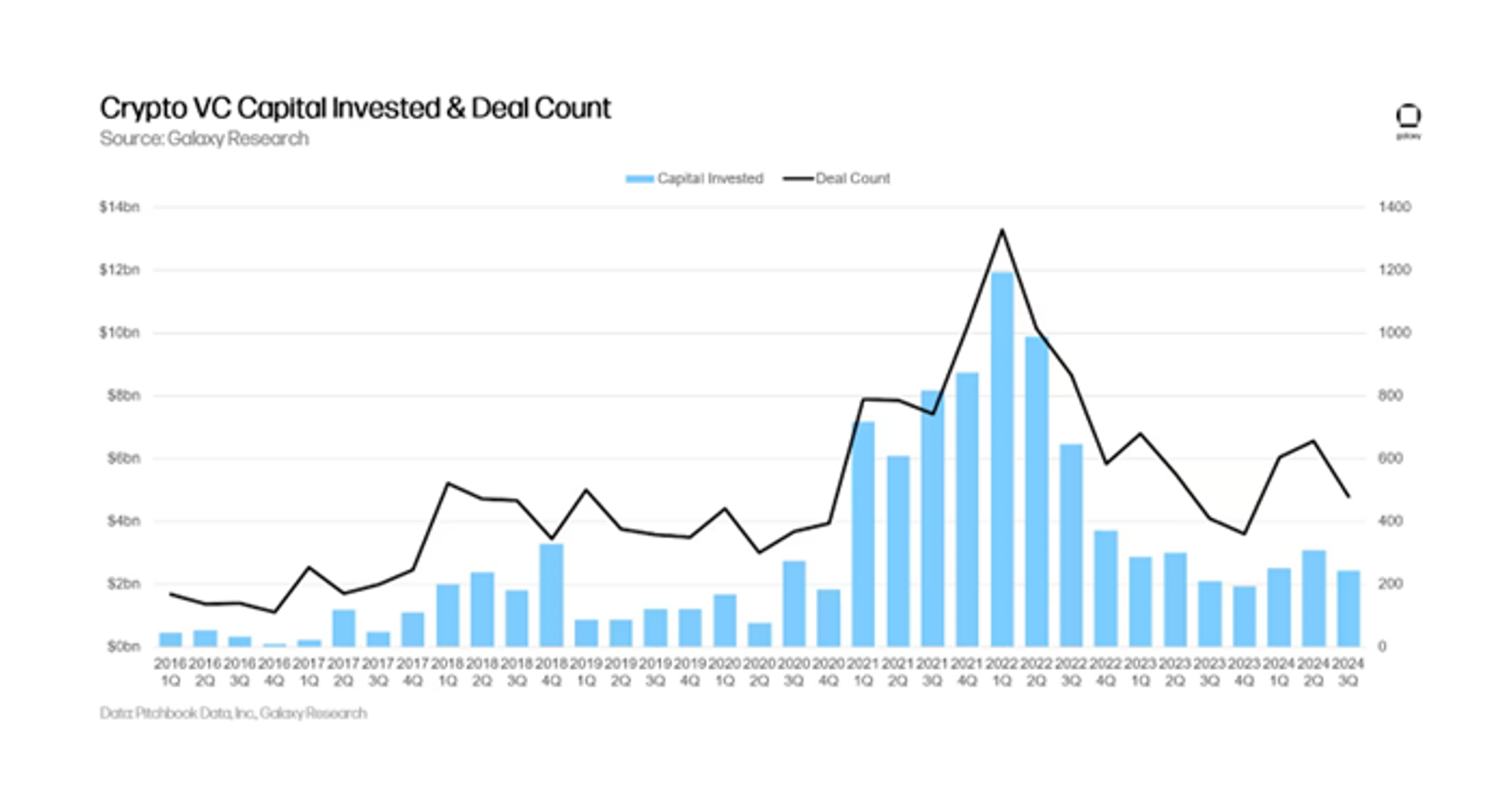

The crypto VC industry has experienced significant shifts in recent years, shaped by market volatility, regulatory challenges, and evolving investment strategies. In the earlier days, crypto was even more of a speculative and risk-on asset. Most, if not all institutions did not adopt crypto into their investment portfolios as it was simply too volatile. However, there was still demand from groups of Accredited Investors (AIs) who saw crypto as a sector that had high risk but offered high rewards. This group of risk-taking AIs were the liquidity providers (LPs) for the crypto VC funds back in 2015-2017. It wasn’t until 2018 where crypto picked up more traction as people saw the potential of crypto VC to provide outsized returns via a moonshot approach, riding off the back of the Intial Coin Offering (ICO); crypto VC was like traditional VC but on steroids. Then came 2021 where this “fear of missing out (fomo)” proliferated, inciting more capital to flow into crypto VCs as AIs and institutional investors alike fought for the piece of the pie. This resulted in a peak of nearly US$12 billion invested in the first quarter of 2022, an all-time high.

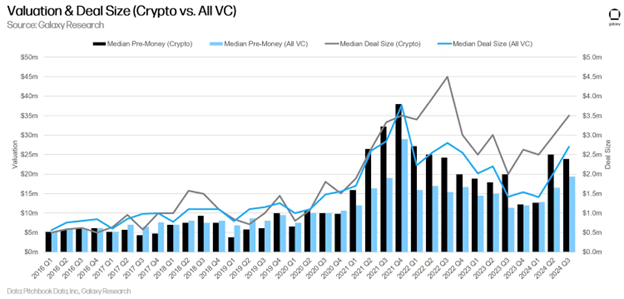

Along with the inflow of liquidity, came the inflation of crypto deal valuation. Crypto VC deal valuations were inflated alongside traditional VC deals especially in 2021 and 2022, spurred on by multiple factors such as a post-covid recovery, low interest rate environment, tech boom, Special Purpose Acquisition Company (SPAC) and ICO frenzy etc. However, towards the end of 2022, crypto VC valuations were especially inflated, at more than a 65% premium as compared to the traditional VC counterparts. Unfortunately, these valuation amounts then saw a sharp correction soon after.

More recently, in 2024, VC firms invested approximately $13.7 billion into blockchain and crypto startups, reflecting a 28% increase from the previous year. However, despite this growth in capital deployment, the total number of deals declined by 46% from Q1 to Q4, indicating that investors have become more selective in their approach. Currently, valuations in the crypto VC space are definitely still inflated. Along with the US tariff situation, the economic backdrop is set for disruption and uncertainty as major global powers try to come to an agreement. With both investors and founders being more selective in fundraises, as well as concerns from a macroeconomic point of view, we think that crypto VC valuations will eventually get corrected to fair value in due time.

The Rise of Artificial Intelligence (AI) x Crypto

The intersection of AI and crypto has emerged as one of the most dynamic and heavily funded verticals in the crypto VC landscape as of late. In the earlier days, many VC funded projects focused on decentralised compute which often involved a decentralised network of GPUs for rent, allowing users to earn yield off their idle GPUs.

Beyond VC-led initiatives, the AI x Crypto space has seen a proliferation of community-driven projects, particularly those centred around AI agents. These autonomous software entities, powered by LLMs, have sparked a powerful narrative within the crypto ecosystem. Projects like ai16z and Virtuals Protocol ramped up traction at a rapid pace by offering open-source frameworks for developers to build AI agents capable of tasks such as DeFi yield optimisation, social media engagement, and even autonomous trading. This “AI agent narrative” has resonated strongly with the crypto community, as it aligns with the sector’s ethos of open-source innovation. The accessibility of AI tools empowers developers and users alike to create sophisticated applications without requiring deep technical expertise, democratising innovation.

The spirit of crypto is inherently open-source, and AI fits seamlessly into this paradigm. On the user end, AI simplifies complex processes, enabling the average person to enhance their output significantly. One compelling example is “vibe coding”, where users leverage LLMs to rapidly develop products and tools with minimal coding knowledge. By feeding prompts into models like those offered by Grok or Claude, users can generate functional codebases for dApps, analytics tools, or even smart contracts. This lowers the barrier to entry for building in crypto, fostering a wave of innovation from both seasoned developers and newcomers.

In the next section, we’ll explore a practical application of this trend with a case study on a “vibe-coded” wallet tracker, showcasing how AI-driven development can create powerful tools for navigating the crypto markets.

Case Study: “Vibe-coded” Wallet Tracker

We tried our hand at “vibe-coding” as well, producing a wallet tracker that can help us with real-time data and capital flow analysis. It is a data-driven tool designed to monitor blockchain wallets of interest using Cielo’s API, one of our portfolio companies. The project focuses on tracking traders who identify and invest in trending tokens early, often securing substantial profits. By analysing their activity, the tracker provides valuable insights into market trends, liquidity flows, and smart money movements.

Cielo Finance is a portfolio tracking and analytics platform that offers advanced blockchain data tools. It enables users to monitor wallet activity, track market trends, and set up custom alerts based on transactional patterns. With a robust API and real-time data streaming capabilities, Cielo provides deep insights into blockchain transactions, token movements, and wallet interactions. Its features include comprehensive wallet tracking, automated smart alerts and provides market intelligence to traders.

Architecture of the Tracker:

The Wallet Tracker is built using Cielo’s API, integrating various features to filter and analyse transactional data. The system follows this general workflow:

- Wallet Selection – Identifies and tracks wallets that have historically been early adopters of high-performing tokens.

- Data Retrieval via Cielo API – Fetches transaction data, swap history, and token movements from monitored wallets.

- Filtering & Processing – Applies custom filters to extract meaningful insights on trending tokens and liquidity shifts.

- Automated Alerts – Sends real-time notifications via Telegram based on predefined conditions, such as:

- “Alert me when X number of wallets swap into a token with a cumulative volume of at least Y.”

By leveraging LLMs, we are able to put together Cielo API calls and some simple lines of code to get us started on this wallet tracker. We hope that this case study showcases the power of AI and how it can supplement one’s skillset, ultimately increasing the efficiency and output on every one of our actions.

Concluding Thoughts

The crypto venture landscape is at a pivotal juncture, poised for further disruption. The rise of AI x Crypto has been nothing short of transformative, reshaping development workflows and unlocking new product possibilities. From decentralised compute networks to AI agent frameworks like ai16z and Virtuals Protocol, this vertical has captured significant market share and mindshare. The accessibility of AI tools, exemplified by vibe-coding, has lowered barriers to entry, enabling both seasoned developers and newcomers to build sophisticated dApps, analytics tools, and smart contracts with unprecedented speed.

Looking ahead, the crypto space is hungry for fresh narratives and groundbreaking applications. While AI has dominated recent discourse, robotics x crypto looms as a potential frontier. Despite the buzz, tangible robotics applications in crypto remain scarce. The challenge lies in creating compelling use cases that leverage crypto’s trustless and programmable nature to enhance robotic coordination.

Signum Capital remains committed to staying ahead of these trends, actively exploring emerging verticals to identify and capitalise on opportunities that redefine the crypto landscape. By maintaining a finger on the pulse of the industry, we aim to position ourselves and our portfolio companies to seize the next wave of opportunities, no matter where they emerge.

*Disclosure: The information provided on this blog post is for general informational purposes only and does not constitute professional nor investment advice.