Permissionless, Under-Collateralized Credit in DeFi

For DeFi to be useful at scale it needs well-functioning credit markets. For that, RociFi has pioneered the world’s first (1) on-chain credit credential (NFCS), (2) permissionless under-collateralized credit protocol, and (3) decentralized bond markets.

Intro

CeFi and DeFi wanted to improve upon the TradFi models but fell short – the former suffering traditional bank runs and the latter being capital inefficient due to overcollateralization. This lack of maturity has hamstrung DeFi in realizing its full potential.

DeFi’s most recent attempt at under-collateralized credit has catered to crypto privileged elites, i.e. hedge funds and trading firms, which typically borrow and reinvest in DeFi, creating a self-reinforcing build up of speculative bets on the collateral which underpins those loans. This has in part led to crypto’s first over-leveraged debt bubble with bad loans being flushed from the system via mass defaults and bailouts.

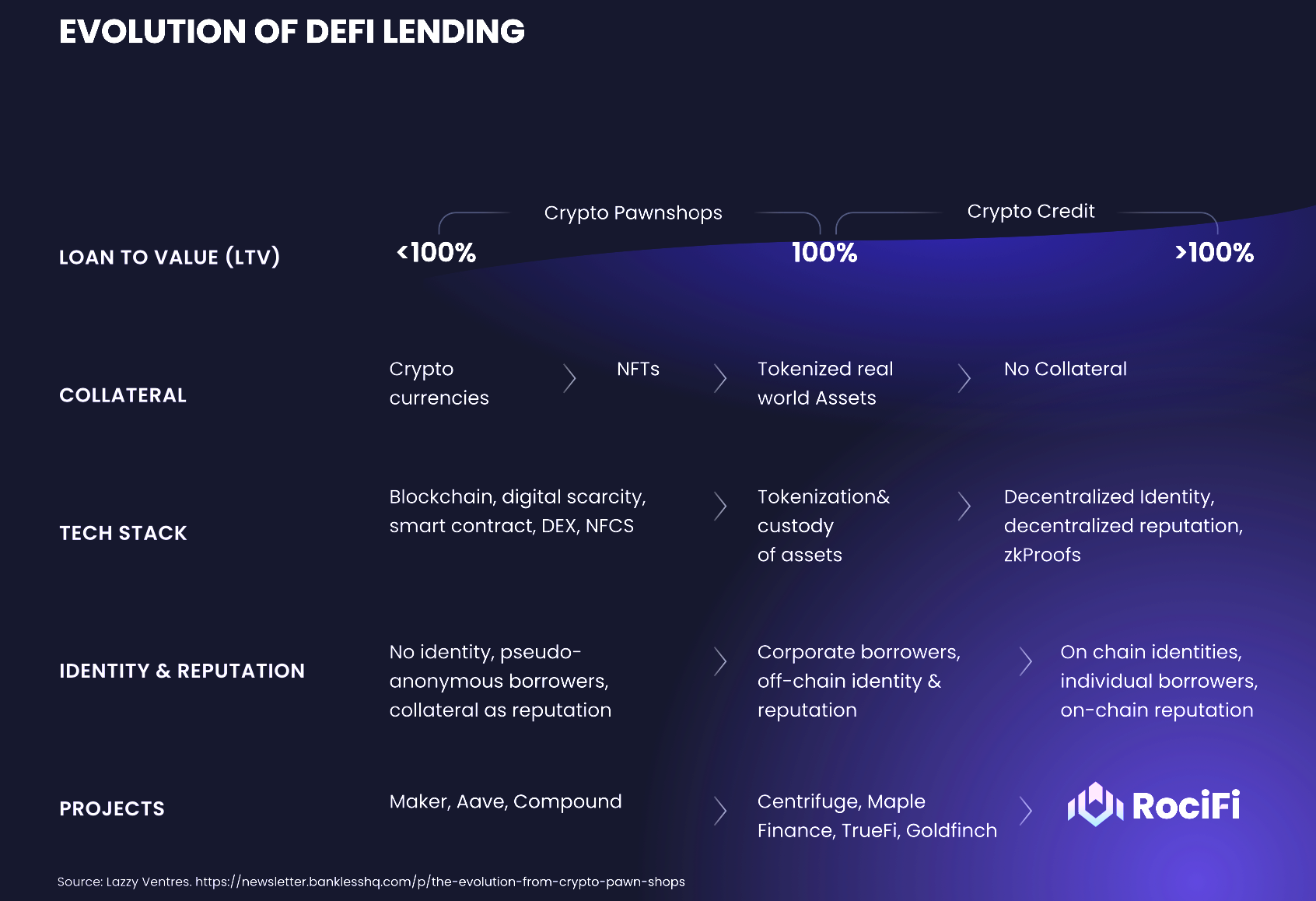

RociFi’s under-collateralized credit protocol reimagines credit scoring, DeFi credit, and the future of bond markets by addressing the aforementioned flaws. In particular, per Bankless’ article, moving DeFi lending from ‘pawn shops’ to onchain-native credit.

Original source: https://newsletter.banklesshq.com/p/the-evolution-from-crypto-pawn-shops

Original source: https://newsletter.banklesshq.com/p/the-evolution-from-crypto-pawn-shops

On-chain Credit and Reputation Credential

The lack of under-collateralized credit in DeFi is due to an absence of:

(a) a non-transferable identity and reputation

(b) reliable data about this identity’s creditworthiness

As Vitalik Buterin, co-penciled the 36-page paper, Decentralized Society: Finding Web3’s Soul:

“Perhaps the largest financial value built directly on reputation is credit and uncollateralized lending. Currently, the web3 ecosystem cannot replicate simple forms of uncollateralized lending.”

To achieve this the paper posits a unique non-transferable on-chain credential that enhances utility and safety across Web3, he describes as Soulbound Tokens.

NFCS

RociFi’s non-fungible credit score (NFCS) long precedes Soulbound Tokens and is designed to be a holistic DeFi credential verifying a user’s credit, reputation, and trust in one ERC-721 token. Once minted, the NFCS is a non-transferable ID unique to that wallet which can contain multiple addresses bundled together (but only one seed phrase). For more information on how this works, read here and here.

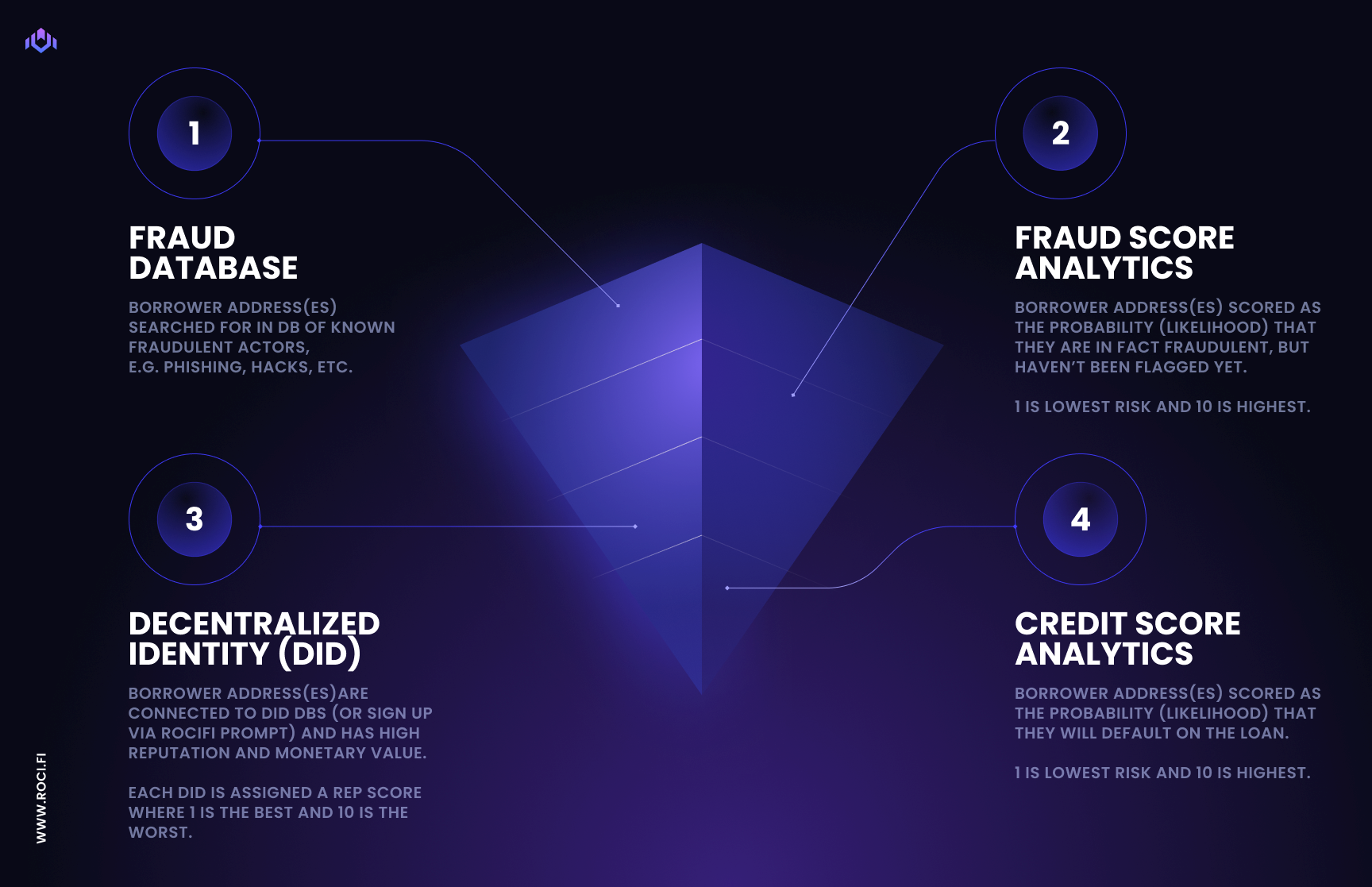

NFCS operates similarly to credit bureaus like FICO where the score belongs to the user, but the user does not control it. RociFi’s on-chain scoring uses standard credit metrics (repurposed for DeFi) of a wallet’s historical on-chain behavior and decentralized identity credentials (DID) to generate a credit risk score from 1 to 10 with 1 being the best and 10 the worst.

The three main components of the NFCS credit scoring process are:

Credit risk: the borrower is able to repay the loan, i.e. creditworthiness

Fraud risk: the borrower is willing to repay the loan, i.e. trustworthiness

Reputation risk: the borrower has something to lose in the event of failing to repay the loan, i.e. social recourse

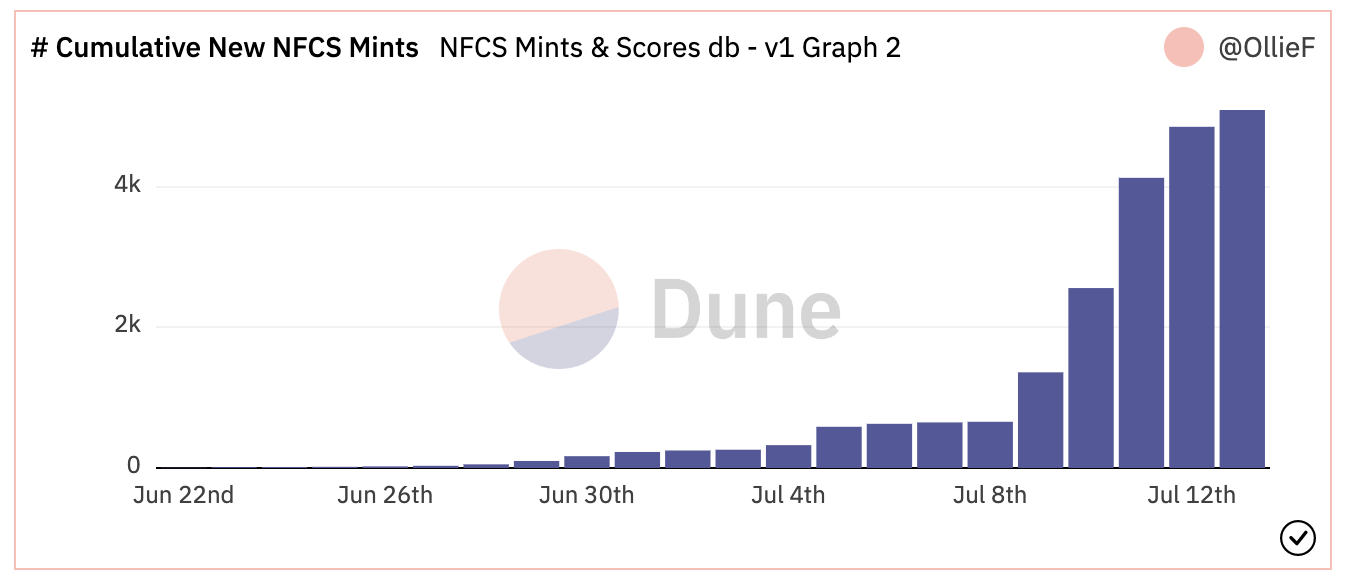

More than 5000 NFCS have been minted in the first 2 weeks of RociFi launch.

Source: https://dune.com/OllieF/rocifi-nfcs

Source: https://dune.com/OllieF/rocifi-nfcs

NFCS API

NFCS and NFCS API can be used by DeFi protocols as a cross-chain interoperable non-transferrable NFT-based identity solution for:

- Enabling under-collateralized loans

- Protecting from fraud and scam

- Using NFCS-based reputation for Sybil resistance in DAO elections

- Balancing DAO voting power according to NFCS reputation

- Prioritizing airdrops and waitlists to quality users

NFCS score is being updated regularly based on users’ latest DeFi activity and their repayment behavior on RociFi lending platform.

DeFi service can query the NFCS API in order to get the most up-to-date NFCS score per given address.

Social Recourse vs Legal Recourse

In addition to NFCS and collateral, the protocol uses ‘social recourse’ to enforce loan agreements and incentivize positive behavior, i.e. non-defaults. To illustrate, before receiving an under-collateralized loan, the borrower must agree to terms and conditions that their provided information – wallet addresses and DID information – will be doxxed on-chain and via RociFi community in the event of a default – damaging their credit and reputation beyond repair.

The natural comparison to legal recourse provided by KYC should note that the former is only effective when your senior debt lien has priority and your borrower is not insolvent, e.g. 3AC.

In essence, RociFi’s social recourse is identical to legal recourse in both good times (loan will be repaid) and bad (borrower defaults), and even superior given it damages a borrower’s reputation on-chain, resulting in a lifetime ban from RociFi and eventually all of DeFi. This is incredibly powerful as on-chain reputation becomes more valuable in the future as DeFi eats more of TradFi’s market share.

Permissionless Under-Collateralized Credit Markets

RociFi’s credit market is organized into three distinct lending pools based upon risk, i.e. NFCS score. This risk-based approach allows lenders to deposit into pools which fit their risk preferences and receive above market rates of return for said risk.

Borrowers are automatically routed to the commensurate pool based upon their NFCS score. Under-collateralized loans come with a 5-day grace period, thus borrowers from these pools are not subject to auto-liquidations. The ‘high risk’ pool will remain over-collateralized, at launch, in order to minimize risk, thus borrowers from this pool will be subject to auto-liquidations in the event of liquidation threshold breach.

At launch, loans are 30-day fixed rate USDC loans with WETH being supported as collateral.

RociFi Debt Token Bond Market

RociFi Debt Token Bond Market

In addition to NFCS, RociFi offers lenders no-lockup period on capital without introducing bank run risk via the debt token, which a lender receives upon depositing their capital into a RociFi lending pool.

The innovation of RociFi debt tokens over their ‘traditional’ DeFi LP token counterpart is that they enable the co-mingling of loans of the same credit score but with different maturities, interest rates and collateral. Allowing debt token holders the ability to hold them for yield or sell them on a secondary market AMM.

This secondary market for debt tokens is the world’s-first decentralized bond market.

The debt token bond market allows lenders to exit their deposit position earlier than the maturity date by trading their debt tokens on AMMs if there’s a lack of redemption liquidity on the protocol. The discount for exiting on AMMs will be determined by the market, which is a feature, not a bug. Debt token trading will be supported by AMMs across Polygon.

Debt tokens are also a risk mitigation mechanism, allowing lenders to quickly and easily clear bad loans off their books, which transfers risk to the individual rather than threatening the system as a whole. Besides immunizing the protocol from bank runs, debt tokens reduce risk in two additional ways – natural diversification of risk in loan portfolio from bundling and impairment signaling of lending pools by debt token trading, i.e. price gyrations.

For more on how we set our dynamic interest rates, see here.

Conclusion

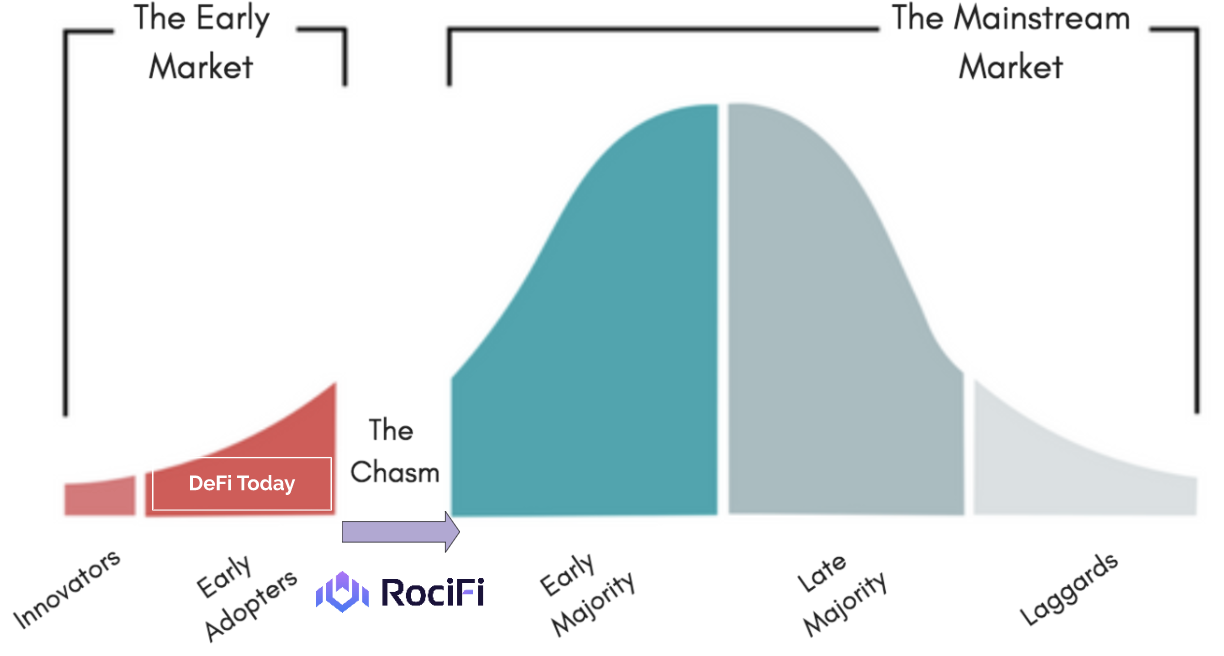

RociFi is the evolution beyond the “crypto pawn shop” model to permissionless under-collateralized credit. RociFi aims to democratize credit accessibility for both on-chain and off-chain individuals and entities via the NFCS, on-chain credential of credit, reputation and trust. As NFCS adoption grows, it will allow DeFi to cross the chasm into mainstream adoption by increasing utility beyond speculation into productive utilization of debt.

We have built the system to make it easily understandable to allow the community to make the right lending and governance decisions in times of stress with the introduction of the debt token. We’ve taken a leaf out of the TradFi manual in our approach to risk management, while avoiding the problems we see there.

For DeFi to be in any way useful at scale we need well-functioning credit markets. For that, we are very proud to be pioneering the world’s first on-chain credit credential (NFCS), permissionless under-collateralized credit protocol, and decentralized bond markets.

___

If you are interested to find out more:

We believe the best way to familiarize yourself with the future of credit is by experience. We have many instructionals on our blog along with a user-friendly interface on our site. Enjoy!

- Familiarize yourself with RociFi content

- Got to the site and mint your NFCS to check your credit score

- If your pocketbook can handle it, deposit or borrow on RociFi credit markets

________

Author Bio

RociFi is a Signum Capital portfolio project

Chris Brookins is the Co-Founder of RociFi, DeFi’s first under-collateralized credit protocol. Chris is formerly a quant crypto hedge fund manager, corporate debt portfolio manager, and Carnegie Mellon alum.

______

RociFi: Under-Collateralized Credit Protocol on Polygon

Follow them on Twitter: https://twitter.com/rocifi

Join their Discord: http://discord.gg/tGgKkSqHZz

Join them on Telegram: http://t.me/RociFi