At Signum, we’ve been researching various innovations in the MEV space. The implications for end-users is significant, and is one of the factors preventing more widespread crypto adoption. Our vision of the future is for MEV to be an issue that users don’t have to worry about, but also potentially benefit from.

In this article, we’ll cover a brief overview of MEV, examine a few interesting innovations in the space, and identify a few ways we think VC’s should think about the future of MEV.

What is MEV?

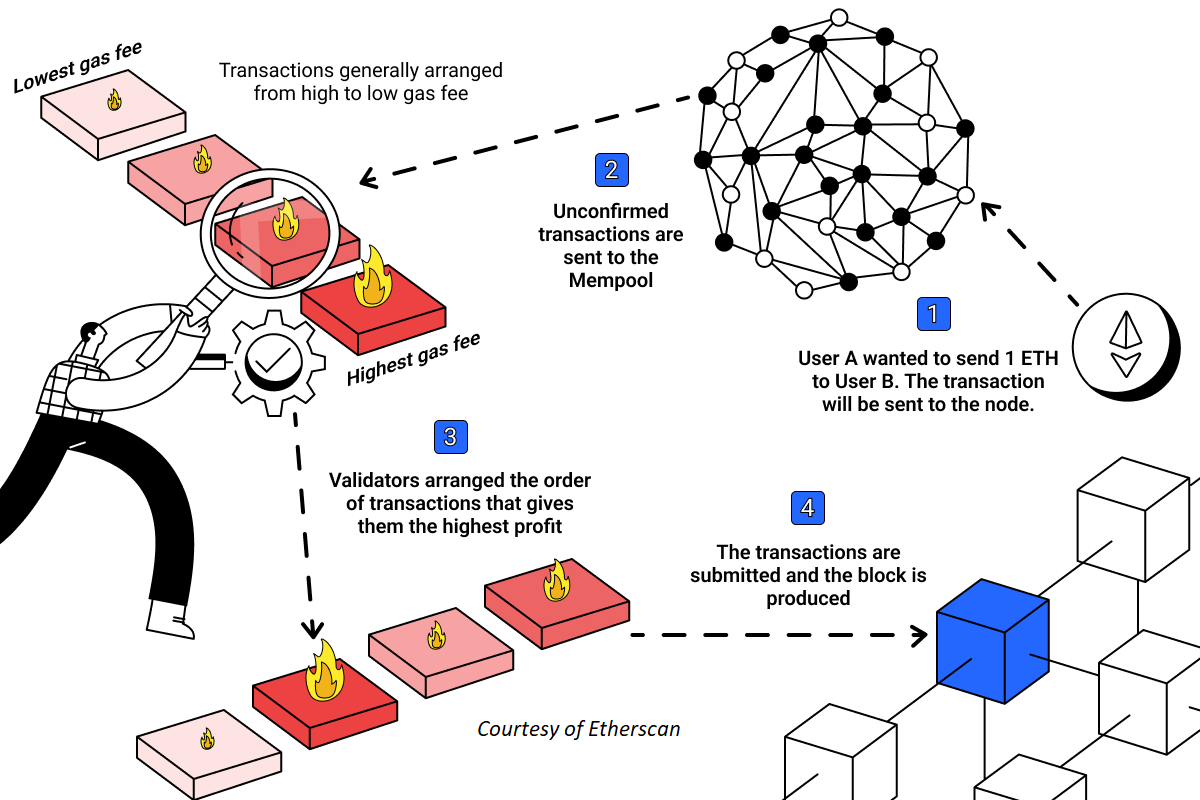

MEV (Maximal Extractable Value) is value created from reordering, adding, and/or not including transactions in a block. A simple example: consider an AMM like UniSwap where the price of a token changes slightly after each transaction according to a specified price equation. Users send transactions to a mempool, where MEV searchers can look for certain opportunities: let’s say there is a large transaction of buying 1 billion of some token – this will move up its price by quite a bit.

If you can manage to put in a buy order before this purchase, and a sell order immediately following this order, you can earn the “guaranteed” difference because of the automatic price-adjustments present in AMM’s. There are numerous MEV techniques, including sandwich attacks, DEX arbitrage, frontrunning, backrunning, and more which we recommend further readings on.

As we can see, the opportunity lies in the order and inclusion/exclusion of certain transactions in a block. More recently, we’ve also seen the impacts of PBS (Proposer-Builder Separation), in which Builders try to build the most profitable blocks and compete with other builders. Proposers (Validators in POS) then choose the highest bid, accept the block from the builder, and propose that to the network. Additionally, we’ve seen the impacts of relayers, and their role in mediating between Builders and Proposers.

There is interesting economics happening behind the interactions of all these parties, and as a result, complex discussions happen regarding the optimal number of relayers, potential over-centralization throughout the stack, and novel approaches like on-chain auctions and shared sequencers.

Recent MEV Innovations:

Auctioning Transaction Ordering Rights:

Certain protocols are implementing auctions to allow MEV competitors to bid on which block should be accepted. If a projected MEV reward is $100,000, even if bidders pay up to 90% of that value, they can still gain the $10,000 reward at the end. This way, the 90% value that would have otherwise been “lost” can be distributed to contributors or stakers within the network.

For more on On-Chain auctions and censorship resistance, we recommend reading the following research paper by Max Resnick from Rook: https://arxiv.org/abs/2301.13321.

Frequent Batch Auction Process:

The idea is to have orders accepted over a discrete rather than continuous time, uniform clearing price, and sealed bid. Orders can be accepted over an auction interval, meaning people can’t just create artificial transactions after noticing an opportunity, only transactions within the time period are accepted. Uniform clearing price means that limit orders are filled at a uniform clearing price where the quantity of crossing orders is highest. Finally, sealed bid prevents front-running by waiting for the batch auction to finish.

Encrypted Mempools:

Encrypted Mempools have recently gained momentum, with the idea being that you can’t frontrun if you can’t “see” the transactions. Currently, searchers can exploit opportunities since they know the exact size of a transaction in the mempool, but if that and potentially other information is encrypted, it is essentially impossible to frontrun or sandwich.

While promising, the implementations can vary and tend to be quite complicated. For more on encrypted mempools, we recommend the following substack from Job Charbonneau: https://joncharbonneau.substack.com/p/encrypted-mempools.

Decentralized Sequencers:

MEV exists across the vertical crypto stack, and as L2’s and rollups grow, MEV will still be relevant. Specifically, many rollups currently order transactions and build blocks using a single centralized sequencer and a FIFO approach. By utilizing single sequencers, rollups often have to balance between reliability and computational cost.

Decentralized sequencers are networks that can sequence across multiple rollups, and feed those back into the L1, which when designed properly can mitigate some of the harms of having a centralized sequencer, but also the risks of MEV. Current projects in the space include Espresso, Astria.

Future of MEV

Thesis 1: MEV will become less of an issue over time

Great teams are working on ways to mitigate the negative impacts of MEV, and over time we can expect MEV to be a hidden backend feature for most end-users.

However, it will be difficult to predict MEV reward size and relevance over time. On one hand, increased crypto adoption and transactions submitted means the creation of more and more blocks. More blocks inherently lead to more MEV opportunities. Additionally, as more exchanges are created, the more DEX arbitrage opportunities will exist. Lastly, many projects are cracking down on MEV and reducing its effects, and even redistributing rewards back to protocols. MEV’s future depends on the respective growth of each of these factors, and at the moment, things seem to be pointing towards a world of MEV being less and less noticeable in the frontend.

Thesis 2: MEV protection is most relevant in high-turbulence periods

The building blocks for MEV are large buy/sell transactions, and this tends to happen much more regularly in periods of high-turbulence, and market uncertainty. This was experienced in the heavy bull and bear periods through the past few years. Thus, projects building solutions right now will have the most noticeable impact during those turbulent conditions.

As a result, redistributive mechanisms can actually be good for ecosystems in turbulent times, as it enables the entire community to benefit from MEV opportunities, when in the past, those rewards would never have been seen by community members.

Thesis 3 – Modular MEV

Modular blockchains are becomingly increasingly popular and will suffer from much of the same MEV problems that all blockchains do. However, competition for MEV in newer chains etc. will increase and bring more opportunities for MEV. Additionally, there’s more room for MEV innovation across the Modular Stack, just given the number of new protocols and use cases that are emerging.

For example, Skip Protocol is partnering with a large number of projects in the cosmos ecosystem working on redistributing MEV in modular blockchains. Decentralized sequencers as mentioned earlier are also gaining traction and working through complex design choices, with wide-ranging impacts on the modular ecosystem.

Thesis 4 – Good projects recognize and address MEV

Strong product-driven teams recognize the ways MEV can affect the end-user experience, and think about varies integrations that can decrease harmful effects of MEV. More and more, we’ll see teams that integrate with different MEV projects and protocols to stay competitive, and these market effects will force successful projects to address these issues.

When investing in companies that are subject to user-related MEV concerns, we like to see founders who have done their research and have an approach to minimizing harmful MEV for their users.

Conclusion:

There are really interesting innovations and projects in the MEV space, and it would not be surprising if the ecosystem looks quite different even a year from now. If you’re building infrastructure that tackles issues in the MEV space, we want to talk to you! Please reach us through our Twitter DMs at @Signum_Capital.