What Mu Digital brings to crypto

On-chain yield has a few core problems. Most yield streams are volatile and generally short-lived. Moreover, in some cases, yield sources are unclear and feel like a black box. On the other hand, credit markets remain the largest pool of real-world capital, sitting at around US$130 to 150 trillion. Asian credit alone sits near US$20 trillion. However, most of this yield stays off-chain, reserved for banks, funds, and institutions.

Mu Digital focuses on bringing a part of this Asian credit universe into crypto. The team packages Asian bonds and private credit into transparent on-chain products with stable, risk-adjusted returns. In partnership with a licensed Singapore fund manager, these underlying assets sit in a regulated vehicle, and credit selection follows strict institutional underwriting standards.

Mu Digital’s founders have worked on more than US$200 billion in deals across Asia, with a wealth of experience that covers deal origination, structuring, and distribution of credit products for banks, corporates, and institutional investors. Their network across financial institutions in Asia Pacific and emerging businesses seeking private credit feeds the protocol’s pipeline.

Product Spotlight

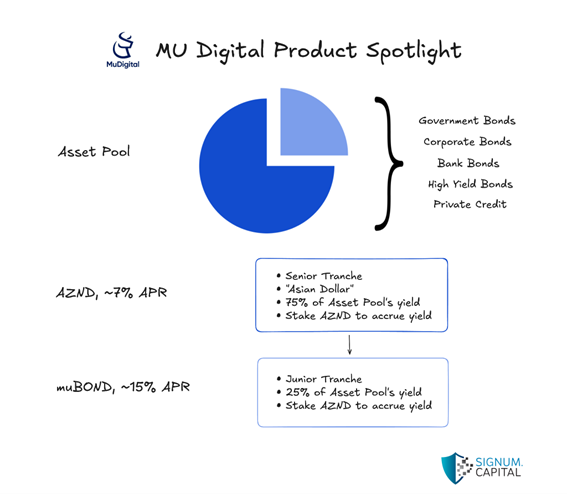

Asia offers a diverse set of sovereigns, banks, and corporates, alongside growing private credit demand from mid-sized borrowers. Mu Digital leans into this with a blended tokenised asset pool which include government bonds, corporate bonds, bank bonds, high yield bonds and private credit.

Mu Digital features 2 core products, AZND, a synthetic stable coin, as well as muBOND. Structurally, AZND represents senior tranche exposure while muBOND represents junior tranche exposure. muBOND also overcollateralises AZND at roughly 118% of the AZND supply. Additionally, 75% of the net yield from the asset pool goes to AZND holders, while the remaining 25% goes to muBOND holders.

Users can exchange stablecoins such as USDC, USDT or AUSD to mint AZND and muBOND. Next, for AZND holders to accrue yield, users must stake their tokens by locking their AZND tokens into the vault. Once that is done, users will receive ioAZND, which is a composable liquid token. Yield is then paid out and accumulated on a weekly basis and is estimated to be ~7% APR. On the other hand, muBOND reprices on a weekly basis to reflect the accrual of yield (~15% APR). muBOND suits investors who are willing to undertake more volatility and credit risk in exchange for higher yields.

A key feature of AZND and muBOND is their composability for DeFi integrations. The team has many DeFi integrations in the works, including bond stripping and yield trading through Pendle, lending and borrowing via Morpho, yield vaults and structured products on various platforms as well as liquid swaps on DEXs such as Curve.

Wen launch?

Mu Digital sits at the intersection of Asian credit and composable crypto primitives, giving crypto users access to stable, verifiable yield sourced from real borrowers and issuers. With AZND and muBOND, you choose between senior stability and higher yielding junior exposure, both backed by institutional underwriting and a regulated structure.

Mu Digital’s Institutional partners are lined up to seed the asset pool, ensuring deep liquidity and high quality credit from launch. The team is currently running a pre-deposit vault for whitelisted community members, with their public launch on Monad being imminent. Watch for the upcoming Monad launch and public pre deposit campaign, and position early as the first wave of on-chain Asian credit goes live.

*Disclosure: Signum Capital holds positions in the aforementioned company. The information provided in this article is for general informational purposes only and does not constitute professional nor investment advice.